Why Silver is Your Family Jewel?

Silver is not just a metal anymore —it has achieved a family jewel status. That emotional bond you feel with heirlooms. The last-resort safety net in crises. Treat your silver stack the same.

If you have bought it at cheap levels in 2024 and 2025, Don't sell. Hoard, Hold, Cherish.

Buyers with "roach motel" mentality are lurking: once it hits their vaults, it NEVER comes out. Roach Motel is a phrase to describe how cockroaches and insects once they enter a motel, they never get out. Similarly, these days, once silver gets into the vaults of central governments, industrial users, it will not get out.

China's slapped export curbs. US lists it as critical. India’s ramping buys. Add to that the industrial users gobbling it up—supply shortage is permanent.

APMEX, a leading U.S. precious metals dealer often compared to the "Amazon of bullion," has implemented a $500 minimum order requirement for online purchases, specifically impacting small silver buyers amid surging demand. This policy change, announced around January 18-19, 2026, by CEO Ken Lewis, aims to manage overwhelming order volumes representing about 50% of their business, effectively rationing access for retail investors. It builds on prior measures, like a $10,000 minimum for sellbacks and earlier $10,000 purchase limits to curb volume.

High silver demand—linked to prices around $93/oz and record Saturdays (today on 23rd January 2026, price of silver has breached $98/oz mark and racing towards triple digit soon) —has strained supply chains, mint output (down 50%), and logistics, prompting dealers to prioritize larger clients. Discussions on Reddit and YouTube frame this as "rationing," with fears of escalating minimums ($1,000+).

Indian gold and silver ETFs have experienced extreme volatility in January 2026, driven by retail frenzy over rumours of import duty hikes ahead of the budget, causing premiums to spike 3-25% above NAV before sharply unwinding. This led to ETF prices plunging up to 20-24% on January 22, far outpacing underlying spot declines of 2-4%, catching many investors off-guard with portfolio shocks.

Investors in India's precious metals can sidestep ETF premium-discount volatility by opting for ETF Fund of Funds (FoFs), which trade at end-of-day NAVs calculated from the underlying ETF's value, avoiding intra-day market swings. While direct ETFs expose buyers to premiums (e.g., 25% spikes) and crashes, FoFs like Silver ETF FoF provide smoother tracking via daily redemptions at NAV, though with a 0.3-0.7% annual lag from higher costs.

Explanation on investing thru ETF and Mutual Funds in Precious Metals:

Direct ETFs expose investors to intraday market dynamics, while Mutual Fund ETF FoFs provide a more averaged, end-of-day pricing mechanism.

ETF Pricing Dynamics:

Gold and Silver ETFs trade on stock exchanges like stocks, so their prices fluctuate throughout the trading day based on real-time demand and supply. This can lead to premiums or discounts over the underlying metal's spot price—for instance, surging demand for a particular Mutual Fund Silver ETF could push its premium higher intraday, only for it to correct later as arbitrageurs step in. Investors buying at peak premiums on such days would indeed face immediate paper losses next day if those premiums collapse, separate from any change in the metal's actual price.

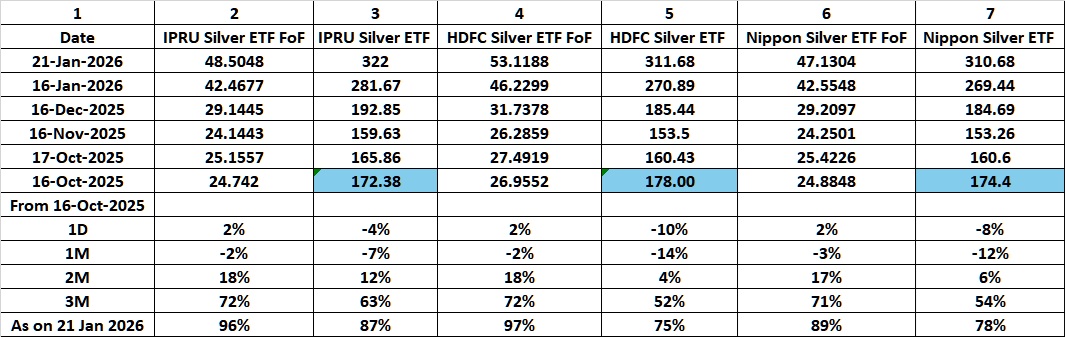

An actual example of such an event was witnessed not only in past few days, but also in October 2025 when most fund houses stopped fresh inflows in their ETF FoF of Precious metals. Those who bought when premiums spiked have earned less returns than their counterparts who had invested through ETF FoFs:

Above table depicts returns for someone who invested at higher premiums on 16th October 25 through ETFs v/s someone who had invested through ETF FoF on the same date. Returns differential even over 3 months or till 21st January 26 is quite substantial, ranging from 6% for 1 day to 5% over 1 month to 6% over 2 months to 9% over 3 months to 9% till 21st Jan 26 from 16th Oct 25 in the case of I Pru example.

Mutual Fund ETF FoF pros and cons v/s ETF investing in Precious Metals:

ETF FoFs, such as those investing in Gold/Silver ETFs, operate like regular mutual funds: units are bought or redeemed at the end-of-day Net Asset Value (NAV), which reflects the average closing prices of the underlying ETFs. This shields investors from intraday volatility and premium swings, ensuring a consistent daily average price. Variations in NAV arise mainly from tracking error (how closely the FoF mirrors ETF performance) or expense ratios, which are typically slightly higher in FoFs than direct ETFs.

Key Trade-offs:

Liquidity and Control: ETFs suit active traders monitoring markets, with potential for lower costs but higher intraday risk.

Simplicity: FoFs require no demat account and enable SIPs, ideal for passive, long-term exposure without timing worries.

Taxation: Capital gains in precious metals is considered long term under ETF post 1 year of investment v/s same capital gains gets treated as long term under ETF FoF post 2 years of holding

Strategic Advice:

MF ETF FoFs calculate NAV at end-of-day closing prices, avoiding intraday volatility spikes common in direct ETF trading during silver's backwardation phase. This unified NAV shields investors from buying at elevated spot premiums, which have persisted since October 2025 amid physical shortages.

Backwardation Context:

Spot silver trades above futures due to supply constraints, signalling acute physical demand exceeding availability. Direct ETF purchases during market hours risk higher entry costs as prices surge intraday, while FoFs lock in closing values for stability. In prolonged backwardation, prioritize FoFs for averaged costs unless accepting storage/logistics for physical silver to fully harness scarcity premiums.

Hence, to avoid getting trapped in such volatility (where you may end up investing at higher levels during market hours through ETFs, it would be prudent to invest through MF ETF FoF which has unified NAVs based on closing prices of the metals (except tracking errors and expense ratios). This is made amply clear in the example shown in the table above for investments made on 16th October 2025 when spot prices quoted huge premiums due to physical silver shortages across the globe.