On 9 October 2025, the view (that was conveyed through a note) was that the powerful bullish technical structure in silver – most notably the 45-year Cup and Handle formation – together with the possibility of silver first clearing the long-term ceiling of 50 dollars per ounce and then advancing towards 62 dollars, justified rotating a portion of profits from gold into silver to capitalise on this trend. Once that 45 year resistance at 50 dollars per ounce was broken and sustained on strong volumes, fresh allocations were also to be directed to silver rather than gold. In addition, a potential “silver squeeze” – triggered by heavily short positions held by banks and institutions – had the capacity to drive prices sharply higher in a very short span of time. In essence, the thesis then was that shifting part of gold profits into silver was a strategic way to benefit from silver’s undervaluation, growing industrial demand, and powerful bullish momentum.

Silver has since behaved exactly in line with that framework, breaking out above the nearly four-decade resistance around 50 dollars per ounce and going on to register fresh all time highs around 69 dollars per ounce, while gold has once again surged past 4,400 dollars per ounce after consolidating sideways for a few months near its earlier historic peak. This has translated into year to date gains of over 70 percent in gold and more than 130 percent in silver. At these levels, investors understandably face the dilemma of whether to lock in gains or continue riding what still appears to be a powerful structural bull market in precious metals as 2026 approaches, with greed encouraging investors to stay fully invested while memories of the sharp post-1980 and post-2011 silver corrections stir fresh caution.

An earlier article of mine (https://www.misterbond.in/article/precious-metals-rally) compared the 2025 precious metals rally with those in 1980 and 2011, and argued that the present advance is fundamentally different from those earlier, largely speculative spikes. Even so, it now makes sense to systematically protect paper profits by taking money off the table to the extent of roughly 33 to 50 percent of original capital, thereby reducing the average cost of holdings in both gold and silver, and then remaining comfortably invested in a reduced cost core position for the long term.

The broader view remains that precious metals continue to be in a structural bull market, for reasons already laid out in multiple notes over the past year.

In the case of silver, the underlying fundamentals have in fact strengthened further:

- India has, for the first time, formally enabled borrowing against silver as collateral under RBI’s unified gold and silver lending framework, putting it on a more equal footing with gold in the credit system.

- The United States has now added silver to its official list of critical minerals, recognising its strategic importance for economic security, clean energy, and defence applications

- Samsung’s move to secure silver linked supply in Mexico for silver rich solid state EV batteries underscores how new technologies could sharply increase per vehicle silver usage, amplifying long-term demand

- China has tightened controls on silver exports, effectively restricting outbound flows and adding a geopolitical layer to supply risk

- The global silver market is running a structural deficit for the fifth consecutive year, with annual demand persistently exceeding mine supply and recycling

- In prior precious metals bull markets, the gold to silver ratio compressed into the 17–30 range, whereas today it still trades much higher, leaving substantial room for silver to outperform if the ratio reverts towards historical extremes

- Large mainstream institutions are increasingly advocating portfolio allocations closer to 60:20:20 between equities, gold, and bonds, instead of the traditional 60:40 equity:bond split, signalling a secular re-rating of monetary metals within strategic asset allocation models

- Most of the short positions in silver by mainstream bankers seems to be over. J P Morgan has now taken long positions in a pivot from their earlier stance

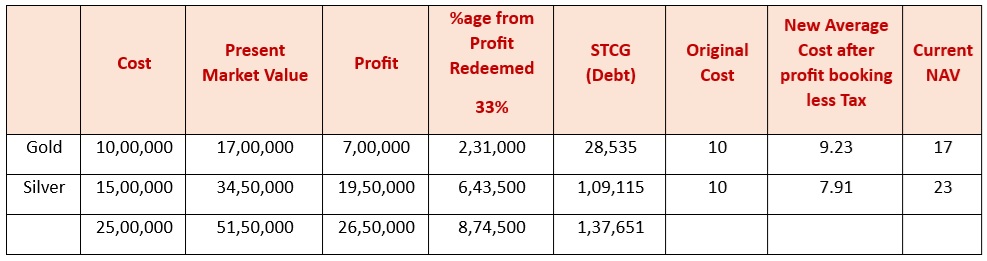

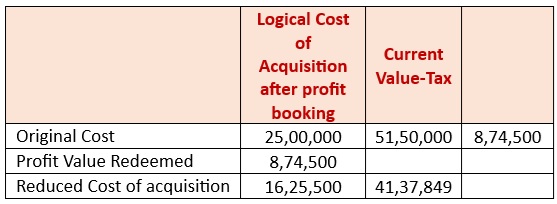

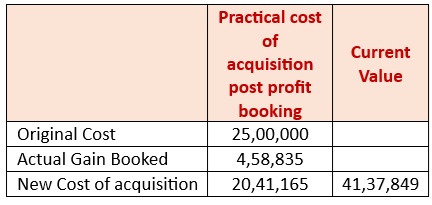

Following are examples of 70% profits in Gold and 130% profit in silver, booking 33% profit and its implications on STCG, new average cost of holding v/s current NAVs. This will give an idea of how much cushion is added due to this exercise:

A lay investor often views profit-taking to eliminate the original cost basis, creating psychological comfort for holding the remaining position through volatility. For instance, if Rs 10 lakhs doubles to Rs 20 lakhs, booking Rs 10 lakhs in profits resets the effective cost of the balance to zero, allowing worry-free long-term ownership.

Profit-Taking Mechanics

This approach recoups the initial capital, transforming the portfolio into "house money" where future gains are pure upside. Investors feel secure knowing the principal is protected, reducing emotional stress during market swings. It aligns with disciplined risk management in bull markets like the current precious metals rally.

In contrast to the layperson's view, actual profit booking does not automatically erase the original cost basis of the remaining holdings. When an investor redeems Rs 10 lakhs worth of units, the profit realized is simply the difference between the current NAV and the original NAV of those specific units, taxed as short-term or long-term capital gains depending on the holding period.

Tax Reality

This gain—current NAV minus original NAV—incurs STCG or LTCG tax at applicable rates, leaving the investor with net proceeds after tax. The cost basis of unredeemed units remains unchanged, based on their original acquisition cost. No automatic "cost reset" occurs for the portfolio

If an investor does partial profit booking, say, 33% of the profits, switch that to respective liquid schemes till such time they may get an opportunity (read corrections in precious metals or in equity) to reinvest. This exercise will reduce your already low cost of holding further down, convert some notional profits into actual profits and peacefully ride any future volatility that may creep into the precious metals space.

Disclaimer:

These are personal views of the author. This note should not be construed as investment advice. This is for information purposes only